Advertisement

Advertisement

Anthony Rowley

Anthony Rowley is a veteran journalist specialising in Asian economic and financial affairs. He was formerly Business Editor and International Finance Editor of the Hong Kong-based Far Eastern Economic Review and worked earlier on The Times newspaper in London

With Earth on the brink of ecological tipping points, nothing short of a fully coordinated push can prevent worst-case warming scenarios.

Relying on a stock market bubble to quickly create economic growth is tempting but such an approach seldom ends well.

As we wrestle with challenges similar to those before the 1920s slump, let’s not rely on central bankers to save us from economic calamity.

Instead of being grateful, the US and Europe are lashing out at China while simultaneously adopting aspects of Chinese state capitalism.

Advertisement

The recent skittishness of equities is undermining global investors’ confidence and driving them to seek safety in bonds.

The gold price coming adrift from traditional anchors points to deep uncertainty about the world and concern for the global monetary system.

The election of an unorthodox figure to lead the Liberal Democratic Party could allow for much-needed balance between diplomacy and deterrence.

As geopolitical confrontation deepens, the dollar could be heading for a steep fall without any outside help, while gold continues to rise.

At a time when some are intent on promoting division, maybe our only hope for progress is forward-looking institutions like the World Bank.

Markets are beginning to reflect and respond to a fast-growing sense of uncertainty and insecurity in the wider world.

The coming stock shakeout will force the realisation that savings are being directed into areas of fleeting gain rather than at real need.

The Belt and Road Initiative is picking up momentum amid increasing synergy with countries in the expanding Brics grouping.

Government spending has played a big role in boosting the US’ consumption and jobs figures, but how long can this last?

Recent UK and French election results and US turmoil are creating an impression of political and societal instability.

If Western countries want to enter the house the Brics nations are building, it would have to be as genuine partners rather than would-be landlords.

Doubts about the US government’s ability to manage its debt without stoking inflation are sparking the latest round of dire warnings about the risks to the global economy.

Great reforms seem to be born only out of major upheavals. And the IMF enjoys only as much power as its fractious owners are prepared to give it.

Trillions invested in environmental, social and governance has diverted funds away from more worthy sustainable projects.

No state can withdraw from globalisation on its own terms, and the world cannot have one power in effect running monetary policy on behalf of everyone else.

With extreme weather events linked to climate change set to increase in frequency and scale, sustainable infrastructure funding remains critically low. To provide real solutions, financial markets need to get more involved in directing savings towards climate investment.

Asia needs to stop seeing older people as liabilities to be tolerated, and instead view them as assets to be nurtured, through better human resource management.

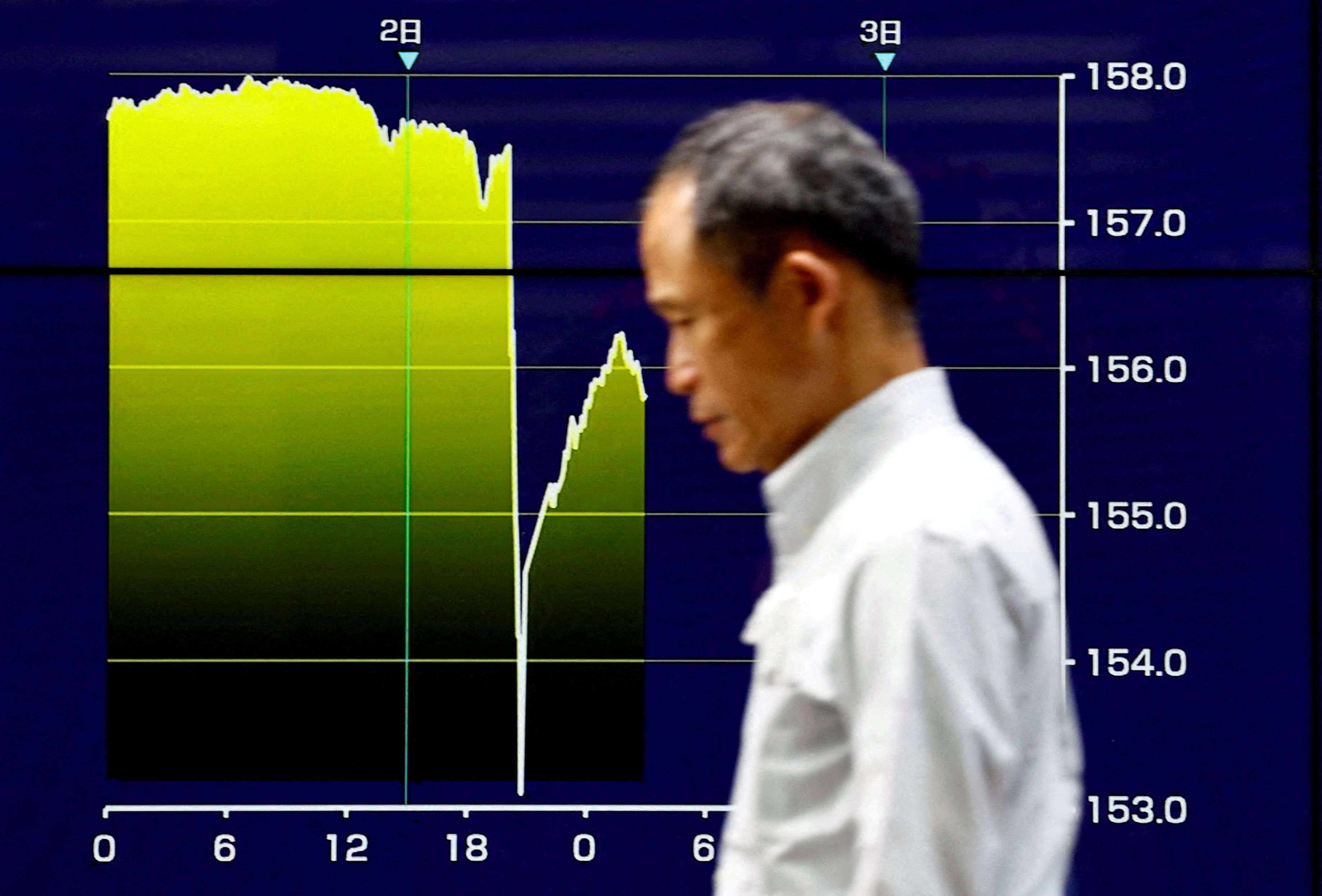

Concerns about an Asian currency war and what it would mean for the world economy have been underpinned by a strong US dollar. Some economies may choose to intervene in currency markets, but the big question is whether China will devalue the yuan or proceed with caution

It is starting to look as if the changes in global economic ties will lead not to a hot war but a new ice age where US- and China-aligned blocs coexist in an environment of slow growth and tension

Stock prices have been a powerful support for the Make America Great Again agenda because the US market is so big as to be the tail wagging the dog. Close attention must be paid to the recent market stumble and America’s slowing GDP growth – where US stock prices go, so goes the global economy.

If wisdom has a place at all, it should be within above-the-fray institutions such as the IMF and World Bank. Yet there is often scant sign of it.

Well-designed policies that support innovation and technology diffusion more broadly can lead to higher economic growth across countries. Policies that limit rivals’ access to technology are hardly best for the world.

The IMF is warning regulators about the systemic risks of the rapidly growing private credit market, a largely opaque sector involving direct lending to corporations

The US, Europe and Japan will not gladly sacrifice their IMF quotas to give China and others more voting rights. But a failure to reform the organisation will worsen rifts and weaken its ability to deal with looming global crises.

Markets and banking systems are stumbling on blindly and greedily towards a repeat of past mistakes both recent and distant. Banks being so big they can lend irresponsibly and ignore those meant to regulate them must change, and the coming crisis could do just that.

Updating John Meynard Keynes’ seminal predictions, IMF managing director Kristalina Georgieva has set out a hopeful scenario for the next century. But the outlook hinges on more sustainable and equitable growth.