Advertisement

Advertisement

James David Spellman

James David Spellman, a graduate of Oxford University, is principal of Strategic Communications LLC, a consulting firm based in Washington, DC.

Volatile oil prices, shaky investor confidence and prospects of interest rate increases threaten a global slowdown if Israel’s war expands.

Digital sequence information holds great promise, but disagreements on definitions and national interests are slowing progress.

The ability of central banks to pursue their main goals will depend increasingly on pursuing reforms in how they think and function.

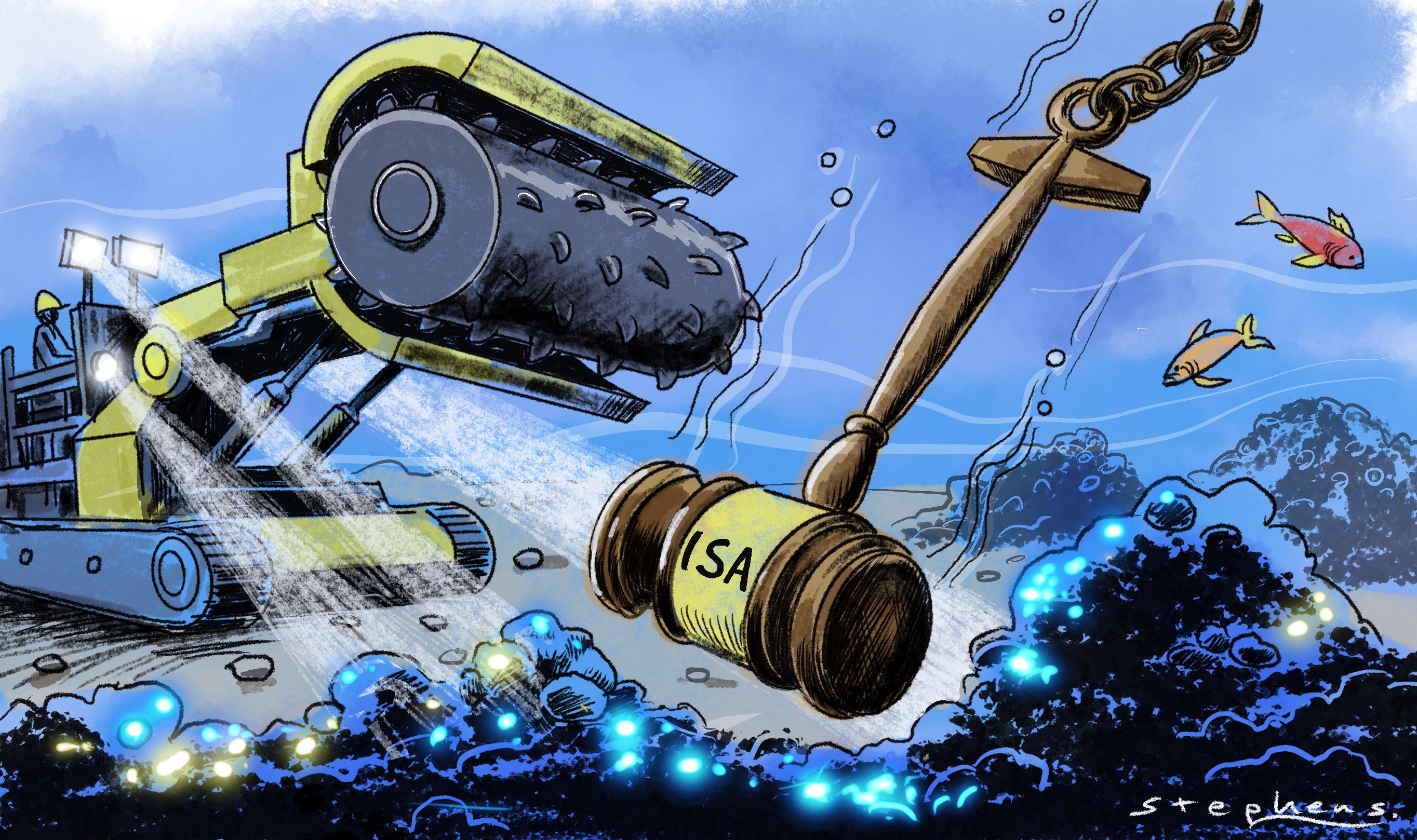

The election of a new chief brings hope of more consensus before governments embark on a deep-sea mining spree harmful to ecosystems.

Advertisement

While artificial intelligence offers benefits to global finance, challenges such as cybersecurity and data biases must be confronted.

While a more conservative European Parliament will be less welcoming to China, bilateral trade deals with EU members could flow more freely.

China’s move to lend giant pandas to zoos in Washington and elsewhere is a gesture of soft power and a sign it does not want relations to reach a point of no return.

China is seizing an opportunity in the Middle East to improve its energy security and global influence, with Iraq a particular beneficiary. This push has its risks, though, and Beijing’s neutrality will face challenges in a region fraught with long-standing rivalries and competing interests.

As Bretton Woods institutions falter, nations like China are pushing for reform that reflects the global reality amid challenges such as debt distress and climate change. While the most likely scenario is marginal changes to the international monetary system, multilateral collaboration should not be underestimated.

The focus is on retooling current approaches when what debt-burdened countries need is an economic re-engineering to produce more lucrative goods and innovative ways to pay down debt using commodities.

While Sino-Arab economic ties have deepened, China is nowhere near replacing the US in the region. Beijing is trying to balance its dependence on Middle East oil with increased arms sales to the region, a development that may prove significant.

The growing influence of middle powers – those too small to be superpowers but still seen as ranking above developing countries – can shape global events. But, as long as great powers can ignore them with unilateral action or by using their veto, this influence is unlikely to shake the core of power politics.

Greater transparency, better oversight, fewer controls and an upgrading of market infrastructure are among the unprecedented changes required to lure back foreigners and address citizens’ fears.

Donald Trump’s pledge of expanded, ‘eye for an eye’ tariffs if he wins the presidency threatens a return to an era of depressed trade and growth. US firms, importers and allies should prepare for the effects of Trump’s possible re-election.

Lessons from the G20’s failed attempts at restructuring sovereign debt must be learned. Why not explore debt-for-development swaps, where loans are in effect turned into investments, and market-based alternatives such as packaging the debt into securities?

Reformers are seeking to advance socioeconomic and climate agendas, but this would only burden trade rules with more hurdles. Any move forward must begin by overhauling the dispute settlement mechanism. With no trustworthy means to resolve disagreements, WTO rules are merely aspirational.

The events that dominated the past 11 months are likely to remain drivers of geopolitics and the worldwide economic outlook as this year’s macroeconomic questions spill over into 2024, with artificial intelligence, productivity growth and renewable energy among the areas to watch.

The slowdown in China’s asset-backed securities is raising fears of a repeat of 2008, when the opaque products triggered a domino effect. China’s potential trouble could start in its beleaguered property sector.

Miracle baby Xiao Qi Ji and his parents are set to leave the National Zoo in Washington unless Beijing extends the panda loan. Dare we hope that the US and China can put their differences aside?

Aside from the domino effect of a Chinese economic slowdown, the US has several deeply vulnerable sectors, from tech and drugs to agriculture and rare earths. A belief that US has little exposure to China’s problems is misguided.

China is unlikely to top US presidential candidates’ talking points as concerns over domestic politics, the economy and the Supreme Court take precedence. Expect both sides to hedge their bets and defer any significant agreements as stable relations and market access are in their short-term interest.

Tech consumers will increasingly be attracted to the latest AI capabilities, rather than hardware; the biggest profits will be in AI software inventions and fee-based apps. With tech manufacturing already facing cost pressures and competition, these transformations will challenge the outlook for many countries.

The failure of negotiations over how to safeguard ocean health and achieve equitable sharing of mining profits has opened the door to new projects. The agency in charge of the world’s seabeds now must consider and provisionally approve any mining requests, making regulation all the more urgent.

Tiktok, AI innovation and the Indian market were in the spotlight at the Oscars for ads this year, while there was less excitement over the Chinese market. As Beijing looks to boost consumption, it should consider giving online marketing a freer rein.

With the US and China each forging their own space agreements with friendly states, perhaps common ground could be found in say, clearing up hazardous space debris

G7 nations and their Western allies have made clear their intent to ‘de-risk’ ties with China without fully decoupling. However, the inability to clearly define the term and differences of opinion between allies on how to proceed could render the efforts ineffective.

Whether it’s peace in Ukraine, Iran and North Korea’s nuclear ambitions, climate change or the Indo-Pacific, few topics will steer clear of China

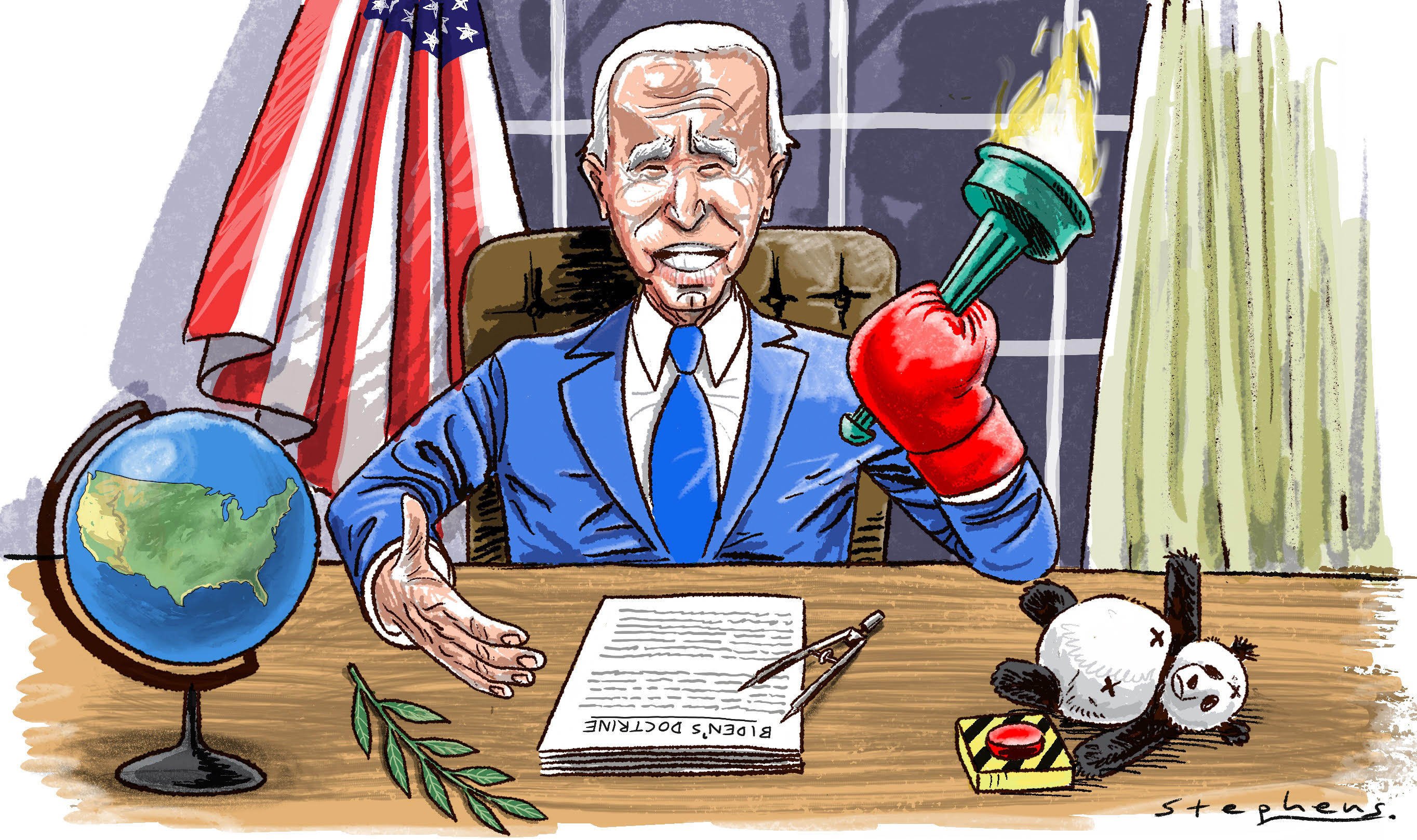

Despite its contradictions, US Treasury Secretary Janet Yellen’s speech in April affirmed at least four tenets of the American president’s doctrine. However, in the run-up to the 2024 election, the moorings of Biden’s policy approach may prove less deeply anchored than suggested now.

The World Bank and IMF have taken baby steps, including setting up a sovereign debt round table, but the plodding approach is likely to be overtaken by emergency action. This is especially as currency risks have yet to be addressed in debt restructuring plans.

China is starting its latest effort to drive a wedge between the US and Europe, but it is unlikely to change fundamental differences that impede warmer ties. Europe wants greater access to China’s markets, but domestic political concerns could keep European leaders from appearing too friendly with Beijing.