Advertisement

Advertisement

Yulu Ao

Reporter, Business

Yulu Ao joined SCMP in 2022 as a business reporter. She previously covered business trends across the Greater Bay Area with topics including financial market, healthcare, aviation, etc. She holds a master's degree in journalism from the University of Hong Kong. Before moving to Hong Kong, she interned in different roles at several news agencies in mainland China.

Anticipated growth of 50 per cent will drive 2024 cross-border investments to about US$48 billion, according to Knight Frank.

Analysts question sustainability of gains given uncertainty surrounding the government’s plans for future stimulus.

Developers still need to offer discounts as market purchasing power is still not sufficient, according to Martin Wong at Knight Frank.

Zhejiang province’s capital lifts price restrictions for homes built on newly acquired land and cuts initial payments for new and used homes.

Advertisement

State-backed China Resources Land said it would withdraw the 2 per cent discounts for all its residential projects in Beijing.

Transactions of new homes jumped 27 per cent from a year earlier in an index that tracks deals across 25 mainland cities.

Strong sales in Shenzhen during the week-long holiday reflect the impact of recent wide-ranging stimulus measures rolled out by Beijing.

Wealthy buyers snap up homes in prime locations amid renewed optimism driven by relaxed purchase restrictions and lower mortgage rates.

Guangzhou is setting the tone for policy deregulation across the country, says Yan Yuejin of E-house China Research and Development Institute.

Chinese homeowners hailed Beijing’s decision to cut mortgage rates by a half-point, though some believe the move will not spark a recovery.

Founder Guo sold 16.38 per cent of the developer to little-known Abu Dhabi-based ‘strategic investor’, trimming his own stake to 13.31 per cent.

Hong Kong court adjourns hearing until December 23 as developer plans parallel restructuring efforts in the city and the UK.

A local regulator in Anhui province is investigating the top-earning live-streamer for misleading consumers in a Mid-Autumn Festival sale.

Potential rate cuts could drive more money into the underinvested living sector in Asia-Pacific, CBRE says.

Worried about job cuts and a lack of high-yield investment options, homeowners are rushing to repay home loans and mortgages in advance.

The smallest cities such as Yangzhou, Huizhou and Dali posted the biggest drops, with their losses widening from July and June.

New addition to its project roster would involve gene sequencing and exploration of genetic information, CEO Clara Chan says.

Case adjourned until September 23 as developer says 75 per cent of loan creditors have agreed to its restructuring plan

Changes to Stock Connect list trigger another round of sell-offs, pressuring the broader market already struggling near an 8-month low.

Wealthy homebuyers see opportunity for flats that cost more than US$14,000 per square metre in prime downtown areas after recent market correction.

The Foshan-based developer said that it plans to postpone for six months the coupon and principal instalment payments on nine notes due this month.

The loss came in 9.4 per cent higher than the top of a range the company defined in a warning last month as home sales plunged nearly 38 per cent.

Shanghai-based Shimao posted an interim loss of 22.7 billion yuan (US$3.2 billion) compared with 12 billion yuan a year earlier. Peers Kaisa, Fantasia and Sunac also struggled with poor home sales.

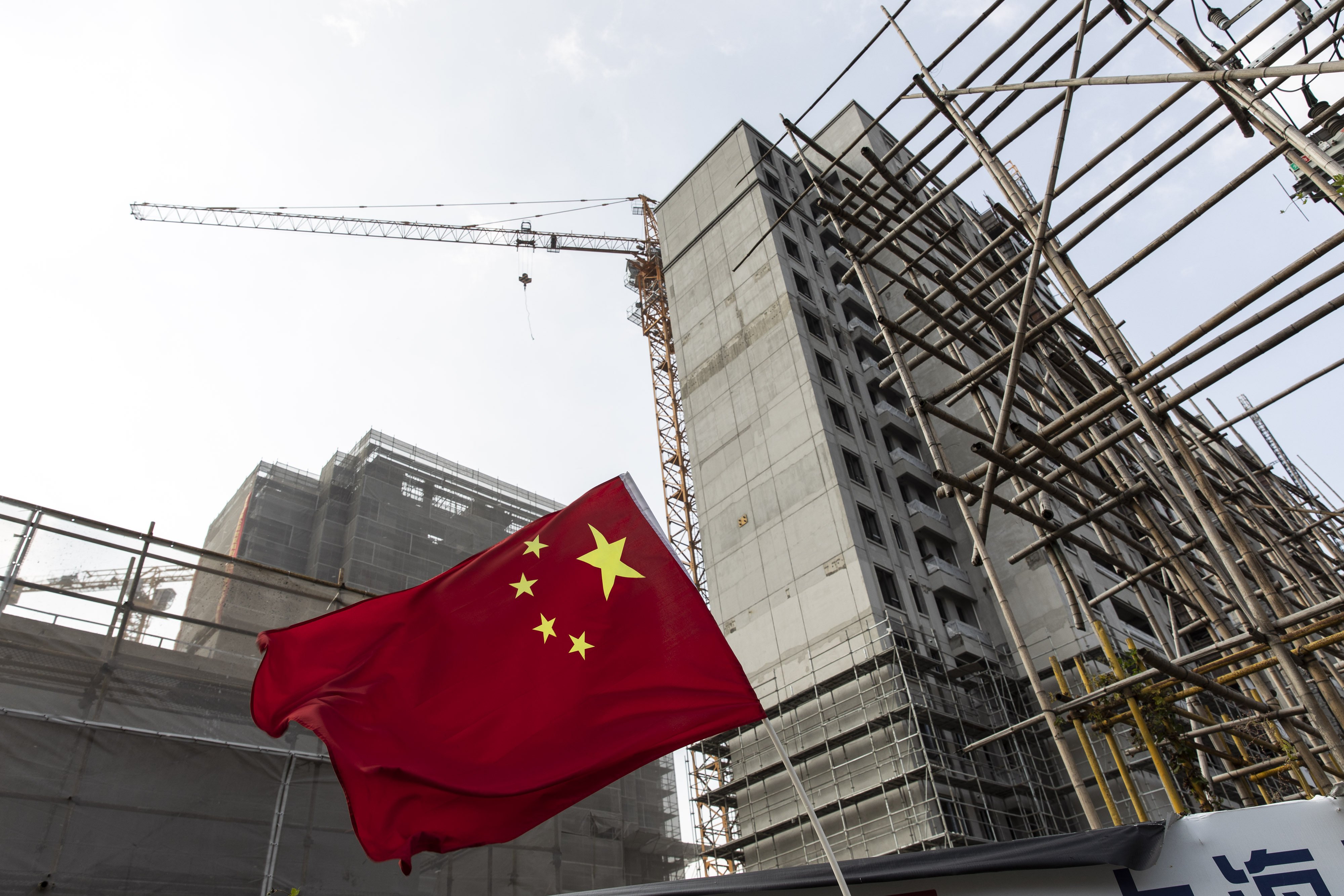

China’s property sector has been beset by woes since 2020, when Beijing introduced the “three red lines” policy to restrict developers’ borrowing binge.

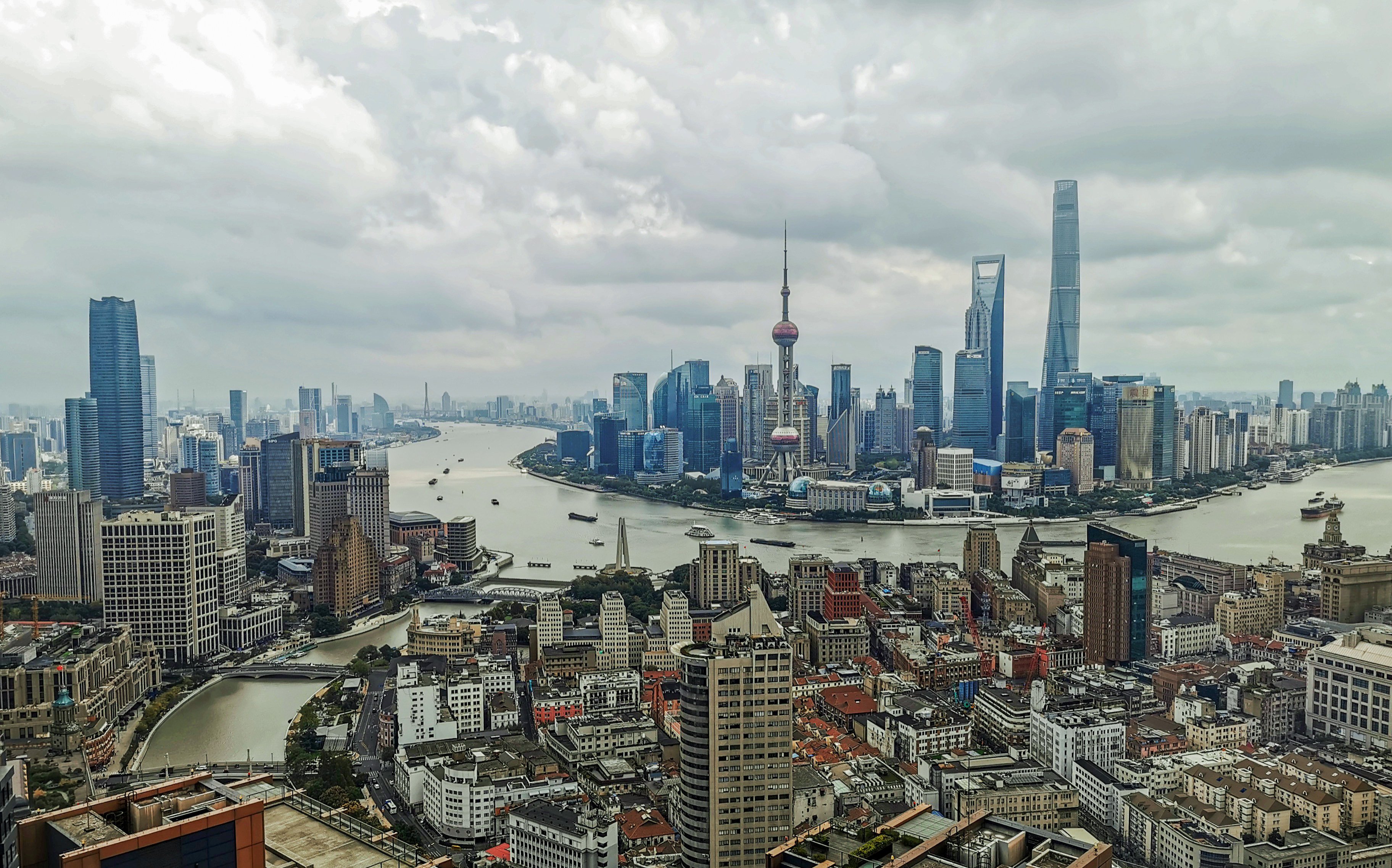

The luxury property market in China remains strong, with high-end homes selling out quickly in major cities like Shanghai and Shenzhen.

The developer’s weak report card is likely to resemble those of most mainland Chinese developers, which are expected to extend a losing streak dating to 2020.

Only about five cities have made purchases so far, according to a China Real Estate Information Corporation (CRIC) report.

Kaisa, with 226.4 billion yuan in total liabilities, has spent more than two years on its restructuring plan since missing its payments in late 2021.

Sales of homes above 30 million yuan (US$4.2 million ) in Shanghai hit a 10-year high in the first half of the year, according to CRIC data.

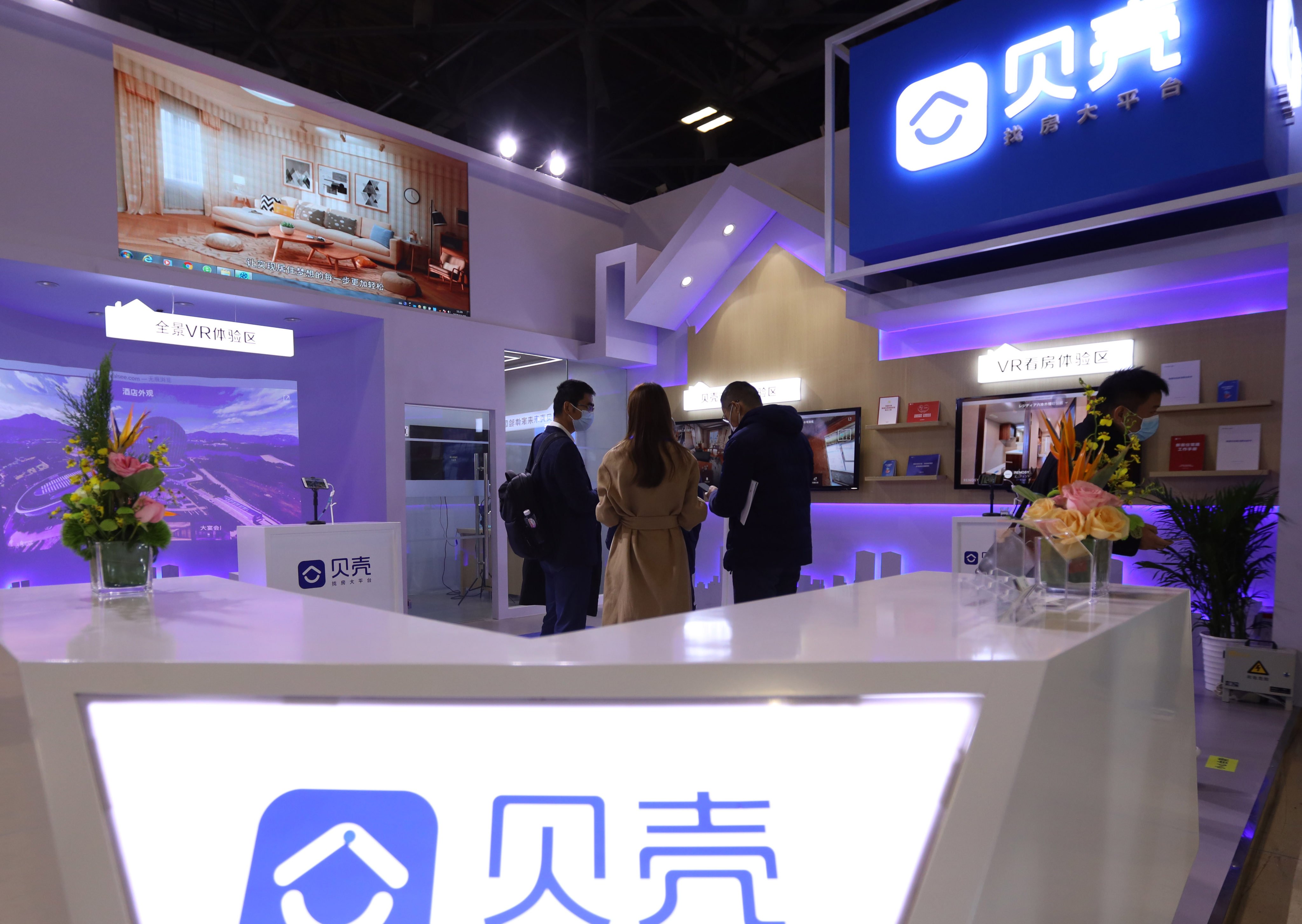

The strong performance, due to increasing transactions in the secondary market of lived-in homes and rental property, offers a counterview and relief to China’s years-long property slump.